Health Plans

explore your health plan options

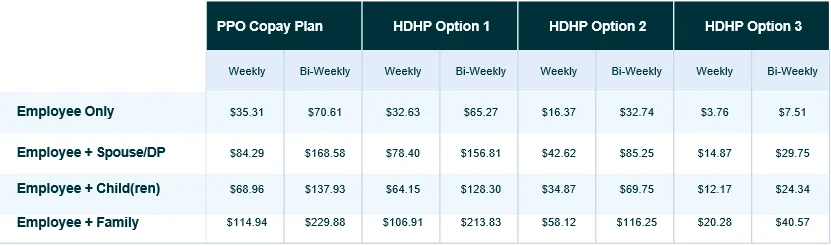

We offer one PPO Copay plan and three high-deductible health plans (HDHPs) that provide comprehensive coverage and financial flexibility. Each plan is designed to support your health while empowering you to take control of your healthcare expenses.

No matter which plan you choose, all of our health plans include:

- Access to high-quality providers.

- Free preventive care covered at 100%, keeping you and your family healthy.

- In-network and out-of-network coverage for added flexibility.

- Comprehensive prescription drug coverage.

- Basic Critical Illness coverage for you and your enrolled family members.

Health Plan Options

PPO Copay Plan

$2,000 / $4,000 Deductible

Summary of Benefits

Summary of Benefits & Coverage

Not HSA Eligible

Ideal for those who use healthcare services more frequently and want set copays.

HDHP Option 1

$2,000 / $4,000 Deductible

Summary of Benefits

Summary of Benefits & Coverage

HSA Eligible

Ideal for those who expect ongoing moderate to high medical expenses.

HDHP Option 2

$4,000 / $8,000 Deductible

Summary of Benefits

Summary of Benefits & Coverage

HSA Eligible

Ideal for those who expect low to moderate medical expenses.

HDHP Option 3

$6,000 / $12,000 Deductible

Summary of Benefits

Summary of Benefits & Coverage

HSA Eligible

Ideal for those who do not anticipate significant expenses and are willing to accept more cost risk if they need care.

Deductible

The deductible is the amount you pay out of pocket each year for covered healthcare services before your insurance starts to pay.

Example: If your deductible is $2,000, you pay the first $2,000 of your medical bills. After that, your plan begins to share the costs.

Coinsurance

Coinsurance is your share of the costs for covered services after you’ve met your deductible. It’s usually a percentage.

Example: If your plan has 10% coinsurance, you pay 10% of the bill and your insurance pays 90%.

Out-of-Pocket Maximum

This is the most you’ll pay in a year for covered services. Once you reach this limit, your plan pays 100% of covered costs for the rest of the year. It includes your deductible, copays, and coinsurance—but not your monthly premiums.

Embedded Out-of-Pocket Maximum

If you have family coverage, each person has their own individual out-of-pocket maximum. Once one family member hits their individual limit, the plan covers 100% of their costs, even if the family hasn’t reached the overall family maximum.

This protects individuals from paying more than the allowed limit—even under a family plan.

Preventive Prescription Drugs

These are medications that help prevent illness or manage chronic conditions before they become serious. They are often covered at low or no cost and may not require you to meet your deductible first.

Examples include drugs for high blood pressure, high cholesterol, asthma, and diabetes.

You may enroll an eligible domestic partner and their children in your health plan, similar to how you would cover a spouse or dependent.

Tax Implications

While premiums for domestic partner coverage are the same as those for covering your spouse or family, there is a tax implication you should be aware of:

- The total cost to cover your domestic partner and/or your partner's children is considered taxable income (i.e., imputed income) and is reported as such on your Form W-2.

This will result in additional income taxes withheld from your pay, so the cost of covering your domestic partner will have the effect of lowering your net income. Click here to learn more.

If you enroll in an Arcwood Environmental health plan and use tobacco, you will be required to pay a $75 monthly surcharge in addition to your weekly or bi-weekly payroll deductions. A person is considered a tobacco user if they currently use any of the following products, including but not limited to: cigarettes, e-cigarettes, cigars, chewing tobacco, smokeless tobacco, snuff, vapor, etc.

How to avoid the surcharge:

- Quit your tobacco use for at least three months. If you're ready to quit, contact HR Services to report your change in status to waive the tobacco surcharge.

- Complete the Freedom from Smoking Plus Tobacco Cessation Program* When you complete this eight-week program, you will receive a certificate of completion statement. Submit this to HR Services to waive the tobacco surcharge. To ensure you have no surcharges for the next year, you must complete this program by December 15. Please call HR Services at 317-390-3148 for a link to participate.

*All employees may participate in the Smoking Plus Tobacco Cessation program. You do not have to be enrolled in one of our health plans to participate. Spouses/domestic partners and dependent children (ages 18 -26) may also participate if they are enrolled in one of our health plans.

Frequently Asked Questions:

When will the surcharge be deducted from my payroll check?

The monthly surcharge will be distributed evenly throughout each month based on your pay cycle. The annual tobacco surcharge is $900 ($75 x 12 months). If you are hired mid-year, the annual tobacco surcharge will be prorated.

My spouse/domestic partner and I do not use tobacco products. How do I avoid the surcharge?

During the benefit enrollment process, you will be asked to affirm your non-tobacco use. It’s that simple!

My spouse/domestic partner and I do not use tobacco products. How will you monitor my tobacco status?

Honesty and integrity are at the heart of our core values. We trust our employees will make the appropriate selection for themselves and their spouses/domestic partners when updating their tobacco status in the system.

Click here to see how primary and secondary health insurance works together.

The Sydney Health mobile app makes healthcare easier. Access personalized health and wellness information wherever you are.

Use the app anytime to:

- Find care and compare costs

- See what's covered and check claims

- View and use digital ID cards

- Check your plan progress

- Fill prescriptions

Scan the QR code to download the app. You can also set up an account at anthem.com/register to access most of the same features from your computer.

Resources

24-Hour Nurse line

1-800-337-4770

Call to speak to a nurse anytime, day or night.

Sydney health App 24/7 virtual care

Need immediate care? Schedule doctor visits 24/7 through live video with board-certified physicians. Costs range $85-$175 per visit. Licensed psychiatrists and psychologists are also available at an additional cost.

Effective 1/1/26, telehealth services through LiveHealth Online are 100% free.

Preventive Care Benefits at No Cost to You

PREVENTIVE RX DRUG LIST

For HDHPs - at low or no cost

For PPO Plan - subject to copay

SUPPORT FOR QUITTING SMOKING

If you're ready to quit smoking, the American Lung Association offers a tobacco cessation program.

traveling outside the u.s.?

When you travel outside the U.S., your Anthem plan covers you in the event of an emergency. Visit bcbsglobalcore.com for more information regarding the 24/7 Services Center contact information and claim forms.